This note describes the main tax aspects of inheritance in France, given that the principles of inheritance contained in the Civil Code do not differ fundamentally from the provisions of other countries of continental law.

Inheritance of property — inheritance tax

Unless otherwise provided by international agreements, the following general principles apply.

When purchasing real estate in your own name, French tax law applies, which establishes a progressive inheritance tax.

- Real estate in France or shares of companies owning real estate are accepted for calculation.

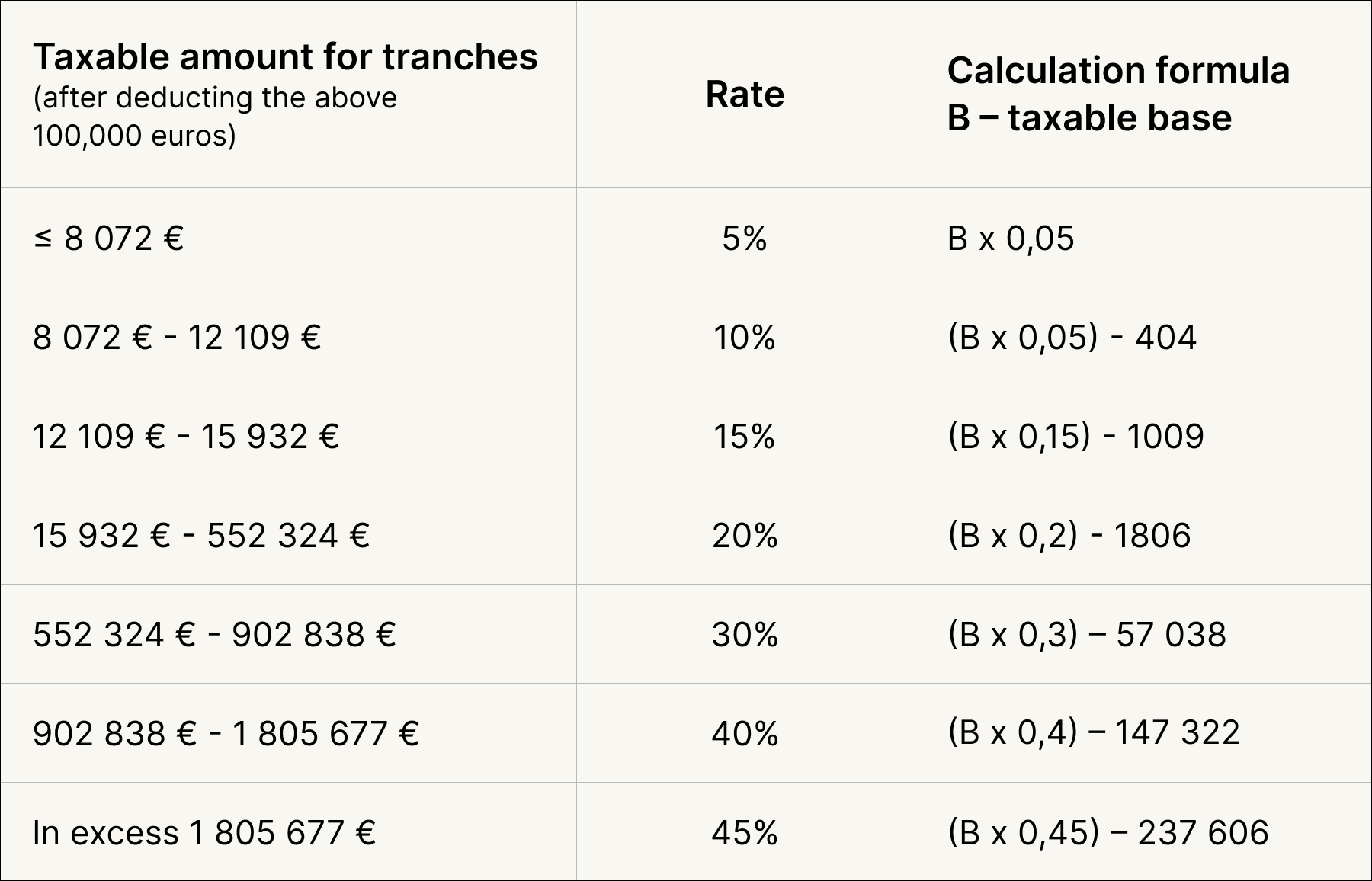

- After that, a fixed amount is deducted from this tax base, for 2023 it is 100,000 euros

- The result obtained after this deduction is the tax base.

The general rule applies to inheritance tax on shares of civil society in real estate, according to which both the increased value of shares and the current account are taxed in France, except for some exceptions provided for by agreements.

Real estate in France or shares of companies owning real estate are accepted for calculation. In this case, the shares are estimated at the market value of the asset on the day of death, minus the company's liabilities, for example, debts to third parties.

Tax calculation

Examples by options

a) Application of the universal property regime

As for the relationship between spouses, then, without the need to revise their basic property regime, it is possible to adopt a Universal community regime with the transfer of all common property in favor of the surviving spouse.

In this case, common children are excluded from the inheritance, and the surviving spouse becomes the sole heir.

As in the case of any transfer of property between spouses, so in this case, the surviving spouse, who inherited the share of the deceased spouse by virtue of Universal Community, does not have to pay inheritance tax.

This advantage, given to one of the spouses, may adversely affect the inheritance of the children, since in this case they inherit only from one parent, that is, they lose the opportunity to deduct from their share of the inheritance a tax-free tranche of 100,000 euros from the first parent. In addition, they risk paying a higher inheritance tax due to the progressive scale.

b) Usufruct

To reduce taxation at the time of inheritance, it is possible to give the so-called naked property to future heirs during their lifetime, while keeping the usufruct.

This type of donation implies the dismemberment of ownership, as a result of which the right of ownership is transferred to the acquirer without the right of use, and the donor retains the right of use, i.e. becomes a usufructuary.

This donation mechanism has two advantages:

- Firstly, with such a donation, the tax base of the donated property decreases. The degree of reduction depends on the age of the donor.

- Secondly, the donor legally retains the right to use the property, even if the acquirer further alienates the property.

For example, if the age of the co-owners of the property is between 51 and 60 years old, the tax base is reduced by 50%.

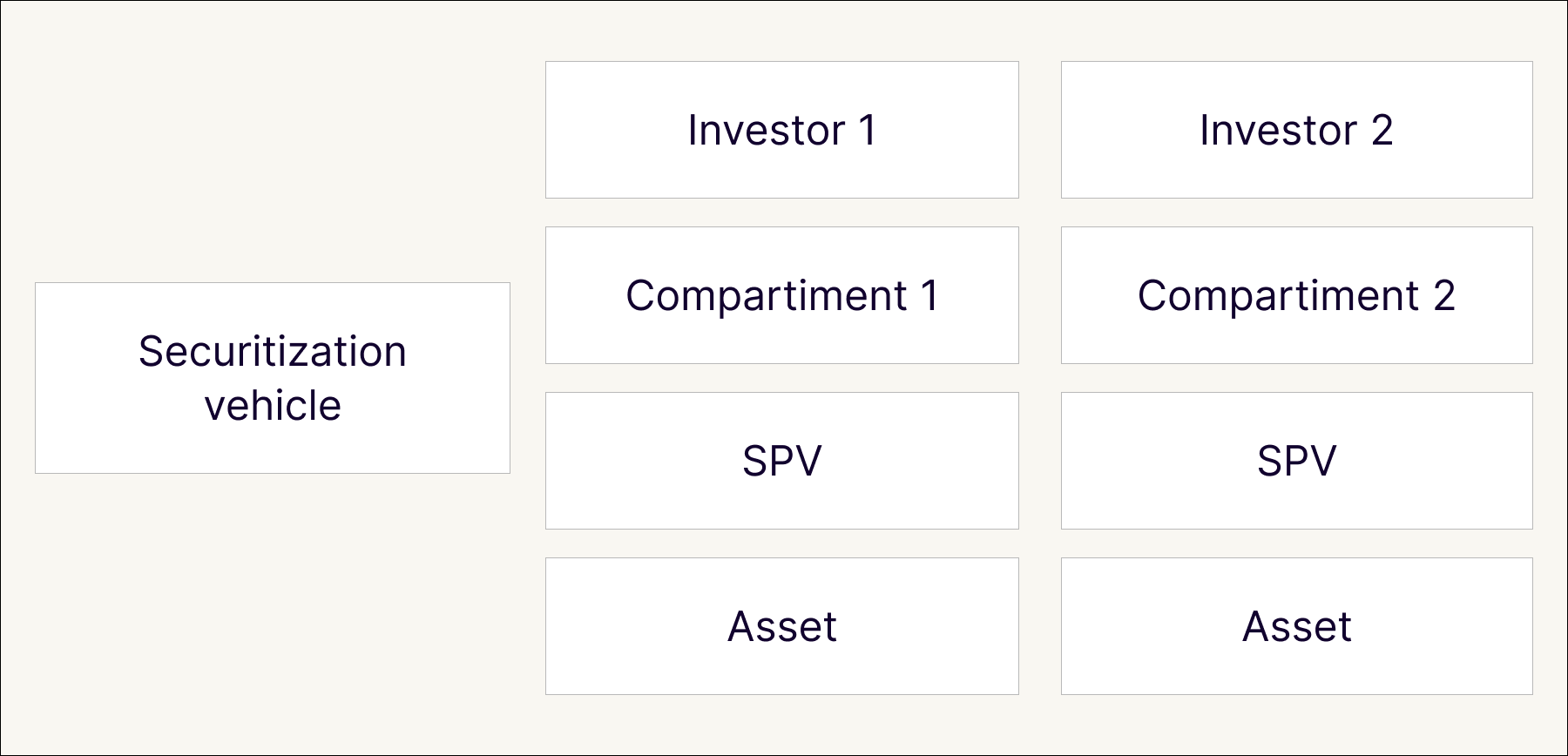

с) Using the Luxembourg Investment Society

From a technical point of view, these companies make it possible to turn assets into registered or nominal securities (bonds, securities and other financial instruments).

The law of March 22, 2004 gives Luxembourg a special legislative framework for such instruments and allows the use of almost any kind of assets: securities, claims, movable and immovable property. In an investment company, several cells are created depending on the wishes of the investor, which are independent of each other, and the liquidation of one cell does not affect the others. Each cell is subject to separate taxation, tax only on profits that have not been paid to the investor. There is no source tax on profits paid to non-resident investors.

As for the SPV, it is subject to income tax in accordance with double taxation treaties, the mother-daughter regime and the directive on interest and royalties.